15 Best Invoice and Payment Tools for Freelancers: Simplify Your Billing Process

Freelancers have a lot to juggle. From managing clients and projects to tracking time and handling payments, the administrative side of freelancing can be overwhelming. Thankfully, there are plenty of invoicing and payment tools designed to help freelancers streamline their financial processes, ensuring that they can focus on what matters most: doing great work.

Let’s explore the best invoice and payment tools for freelancers that not only simplify billing but also help improve cash flow, enhance productivity, and ensure timely payments.

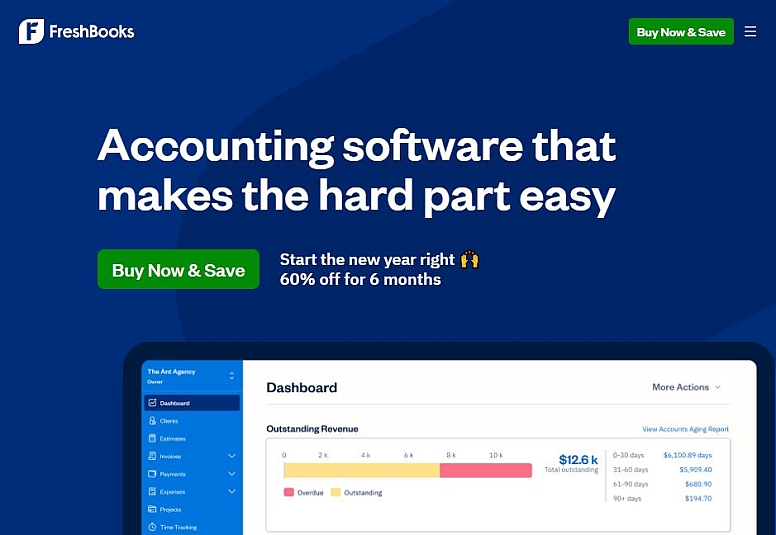

FreshBooks: A Complete Freelance Billing Solution

FreshBooks is a well-known tool among freelancers and small businesses. With an intuitive interface, it’s easy to create professional invoices, track time, and manage expenses. FreshBooks also allows you to accept online payments via credit cards, ACH transfers, or PayPal. Its time-tracking feature ensures that every billable hour is accounted for, making it perfect for project-based work. Plus, the tool can generate detailed reports, providing you with a clear picture of your financial situation.

Why Choose FreshBooks?

- Time tracking and invoicing: Effortlessly log hours and create detailed invoices.

- Automatic reminders: FreshBooks can automatically send payment reminders to clients, reducing the need for follow-ups.

- Multiple payment options: Accept credit cards, ACH transfers, and PayPal payments.

PayPal Invoicing: The Trusted Payment Platform

PayPal is synonymous with online payments, and its invoicing feature is a great tool for freelancers. You can create and send customized invoices in minutes, which clients can pay directly via PayPal or credit card. With PayPal’s widespread popularity, most clients are already familiar with the platform, ensuring smooth transactions. Plus, PayPal’s built-in protection policies offer peace of mind for both freelancers and clients.

Why Choose PayPal Invoicing?

- Ease of use: Create invoices in a matter of minutes and send them instantly.

- Global reach: PayPal is accepted worldwide, making it ideal for freelancers working with international clients.

- Security: PayPal’s fraud protection ensures secure transactions.

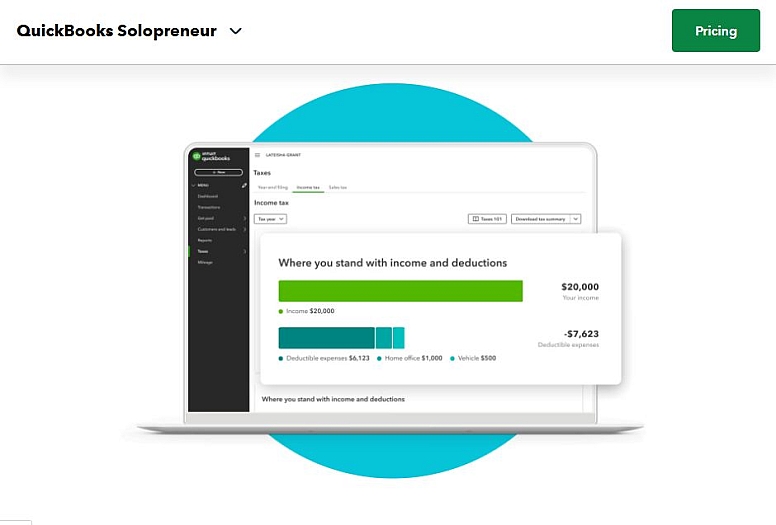

QuickBooks Self-Employed: Perfect for Tax Management

QuickBooks Self-Employed is designed specifically for freelancers and independent contractors. Not only does it help with invoicing, but it also assists with tax calculations and expense tracking. The app automatically categorizes business expenses, making tax time less stressful. Its integration with TurboTax helps freelancers file taxes directly, saving valuable time and effort.

Why Choose QuickBooks Self-Employed?

- Expense tracking: Keep track of all business expenses and income.

- Tax features: QuickBooks Self-Employed calculates quarterly taxes and simplifies tax filing.

- Invoicing on the go: Create and send invoices directly from your mobile device.

Zoho Invoice: Customizable and Feature-Rich

Zoho Invoice is a versatile invoicing tool that offers a variety of features perfect for freelancers. From customizable invoice templates to automated payment reminders, Zoho allows you to personalize your invoicing experience. It also integrates with several payment gateways such as PayPal, Stripe, and Razorpay, making it easier for clients to pay.

Why Choose Zoho Invoice?

- Customizable templates: Choose from a wide range of templates to match your brand.

- Recurring invoices: Set up recurring invoices for clients on long-term projects.

- Time tracking: Track billable hours and add them directly to your invoices.

Wave: The Free Solution for Freelancers

Wave is a great tool for freelancers who need a simple, free invoicing solution. It offers invoicing, accounting, and receipt scanning—all without charging any fees. While Wave is free, it still offers professional-grade features, such as automatic payment reminders and the ability to accept online payments. For freelancers working with small budgets, Wave is an ideal choice.

Why Choose Wave?

- Completely free: No hidden charges or monthly fees.

- User-friendly: Easy to use, even for those with little accounting experience.

- Online payments: Accept credit card payments and ACH transfers directly from your invoices.

Harvest: Time and Invoice Tracking in One

Harvest is another solid option for freelancers, especially those who bill based on hours worked. It allows you to track your time, create detailed invoices, and even accept payments directly through the platform. Harvest also integrates with project management tools like Asana and Trello, helping you stay on top of both billing and deadlines.

Why Choose Harvest?

- Time tracking and invoicing: Manage both time and invoices with ease.

- Online payments: Accept payments via Stripe or PayPal.

- Team collaboration: Great for freelancers working with teams on projects.

Invoice Ninja: Powerful and Free

Invoice Ninja is a powerful invoicing tool that offers both free and paid versions. It’s perfect for freelancers who want to automate their invoicing process. Invoice Ninja allows you to create and send unlimited invoices, track expenses, and accept payments via PayPal, Stripe, and more.

Why Choose Invoice Ninja?

- Free plan: The free version allows you to create and send unlimited invoices.

- Custom branding: Personalize your invoices to match your business’s brand.

- Multiple payment gateways: Accept payments from multiple sources.

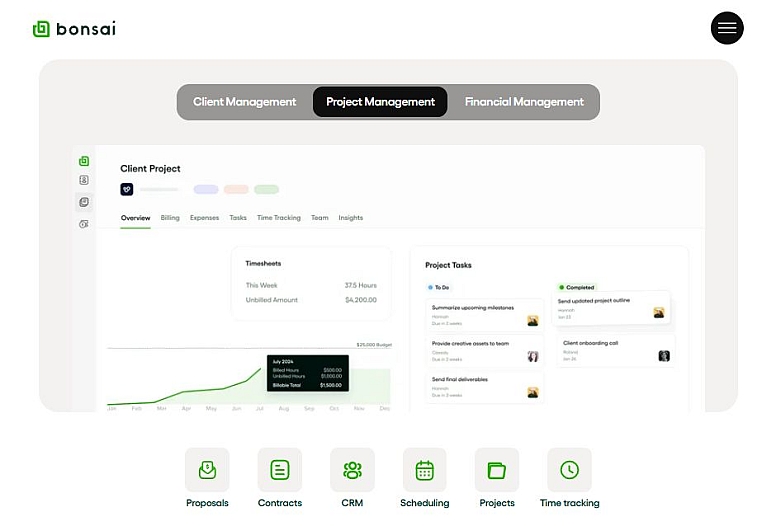

Bonsai: Ideal for Creative Professionals

Bonsai is a favourite among creative freelancers, including designers, developers, and writers. It’s more than just an invoicing tool—it allows you to create contracts, manage projects, and track time. Bonsai also integrates with payment systems like PayPal and Stripe, so you can get paid quickly.

Why Choose Bonsai?

- Contracts and proposals: Create customized contracts and proposals.

- Time tracking: Track time worked and add it directly to invoices.

- Automated invoicing: Set up recurring invoices for ongoing projects.

Square Invoices: Professional Invoicing Made Easy

Square Invoices is a simple yet effective tool for freelancers who need a quick way to send professional-looking invoices. You can create and send invoices via email or text, and clients can pay instantly using credit cards, debit cards, or Apple Pay.

Why Choose Square Invoices?

- Customizable invoices: Create invoices that reflect your brand.

- Easy payment collection: Accept payments via credit card or digital wallet.

- No monthly fees: Only pay when you receive payments.

Bill.com: Streamline Your Billing and Payments

Bill.com is an invoicing and payment solution designed for freelancers and small businesses. It allows you to automate your accounts payable and receivable, making it easier to get paid and manage expenses. Bill.com integrates with accounting platforms like QuickBooks and Xero.

Why Choose Bill.com?

- Automated invoicing: Automate your invoicing process to save time.

- Payment scheduling: Schedule payments for clients and vendors.

- Integration with accounting software: Seamlessly integrate with tools like QuickBooks.

Xero: Comprehensive Accounting for Freelancers

Xero is an accounting software with invoicing capabilities that works well for freelancers looking for a complete financial management solution. It’s especially useful for those who need to track inventory, manage payroll, or generate financial reports.

Why Choose Xero?

- All-in-one accounting: Manage invoices, payroll, and financial reports in one tool.

- Multiple payment gateways: Integrate with PayPal, Stripe, and more.

- Mobile app: Manage your finances on the go with the mobile app.

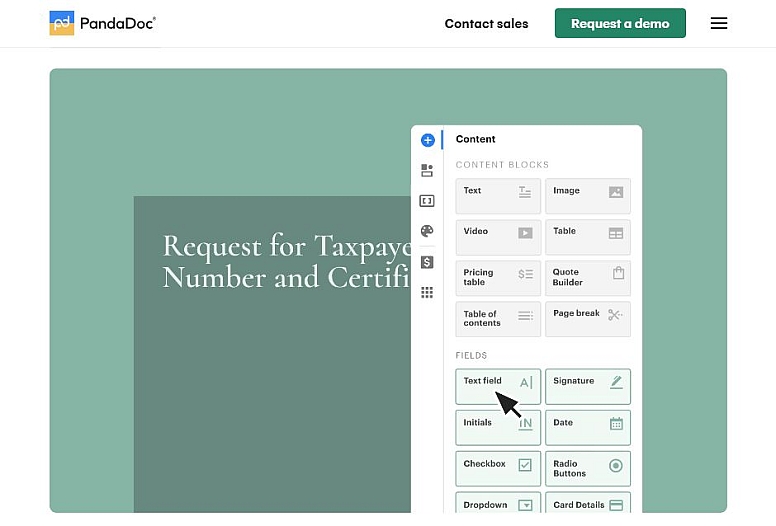

PandaDoc: Contract and Invoice Management in One

PandaDoc is an excellent tool for freelancers who need both contracts and invoicing. It allows you to create customized contracts, send them for e-signatures, and generate invoices—all within one platform. Plus, it integrates with payment systems to make it easy to collect payments.

Why Choose PandaDoc?

- Contracts and invoices: Create both contracts and invoices with ease.

- E-signatures: Collect legally binding signatures on documents.

- Payment integration: Integrate with payment processors like Stripe and PayPal.

Invoicely: Simple and Free Invoicing

Invoicely offers a free plan that lets you create and send unlimited invoices. For freelancers looking for basic invoicing features without the extra cost, Invoicely is a solid option. It also supports multiple currencies, which is ideal for freelancers working with international clients.

Why Choose Invoicely?

- Unlimited invoices: Send unlimited invoices with the free plan.

- Multi-currency support: Perfect for freelancers working with clients from different countries.

- Easy-to-use interface: Simple to navigate for freelancers with no accounting experience.

Tradeshift: Enterprise-Level Invoice Management

Tradeshift is an invoice management platform that’s ideal for freelancers working with larger businesses or organizations. It offers tools for creating, sending, and tracking invoices, and integrates with other enterprise systems for streamlined financial operations.

Why Choose Tradeshift?

- Enterprise-level functionality: Great for freelancers working with larger clients.

- Invoice automation: Automate your invoicing process.

- Global invoicing: Supports international clients and currencies.

Payoneer: International Payments Made Simple

Payoneer is a great choice for freelancers who work internationally. With Payoneer, you can send and receive payments in multiple currencies, making it ideal for global freelancing.

Why Choose Payoneer?

- Global payments: Send and receive payments in multiple currencies.

- Payment flexibility: Pay with a credit card, bank transfer, or eCheck.

- Lower fees: Payoneer’s transaction fees are generally lower than PayPal’s.

Choose the Right Tool for Your Freelance Business

As a freelancer, managing your finances shouldn’t be a daunting task. With the right invoicing and payment tools, you can save time, reduce stress, and ensure that you’re getting paid on time for your hard work. Whether you need a simple, free option like Wave or a feature-packed solution like FreshBooks or QuickBooks Self-Employed, there’s a tool tailored to your specific needs.

Consider factors like ease of use, payment options, tax features, and integration with other tools to determine which one fits best with your business. Most of these platforms offer free trials or have a free version, so you can explore them before committing.

Take control of your invoicing and payment process today, and spend more time focusing on the projects and clients that inspire you. With the right tool, managing your business finances can be just as easy as doing the work you love!